All Categories

Featured

Maintaining all of these phrases and insurance policy kinds directly can be a headache. The complying with table positions them side-by-side so you can promptly set apart amongst them if you get perplexed. One more insurance policy coverage type that can repay your mortgage if you pass away is a standard life insurance policy plan

A remains in place for an established variety of years, such as 10, 20 or three decades, and pays your beneficiaries if you were to pass away during that term. A provides insurance coverage for your entire lifetime and pays when you die. As opposed to paying your home mortgage lender straight the way mortgage protection insurance policy does, conventional life insurance policy plans go to the beneficiaries you choose, who can then choose to settle the home loan.

One common general rule is to go for a life insurance policy plan that will pay out as much as 10 times the policyholder's wage amount. You could pick to make use of something like the DIME method, which adds a household's financial obligation, earnings, home loan and education and learning expenditures to calculate how much life insurance policy is needed.

It's also worth noting that there are age-related restrictions and thresholds enforced by virtually all insurance providers, that often won't provide older purchasers as lots of options, will certainly charge them a lot more or may reject them outright.

Right here's exactly how mortgage security insurance determines up against typical life insurance coverage. If you're able to qualify for term life insurance policy, you ought to prevent home mortgage protection insurance coverage (MPI).

In those situations, MPI can supply wonderful tranquility of mind. Every home loan protection choice will certainly have various policies, laws, advantage alternatives and downsides that need to be weighed carefully versus your exact circumstance.

Mortgage Income Insurance

A life insurance policy policy can aid settle your home's home mortgage if you were to pass away. It is among lots of methods that life insurance policy might help shield your enjoyed ones and their economic future. One of the very best means to factor your home mortgage into your life insurance coverage demand is to speak with your insurance representative.

As opposed to a one-size-fits-all life insurance policy, American Domesticity Insurance coverage Company offers plans that can be made specifically to fulfill your family members's demands. Right here are a few of your choices: A term life insurance policy plan. td mortgage protection plan is active for a specific amount of time and normally provides a larger amount of protection at a lower cost than an irreversible plan

Instead than only covering a set number of years, it can cover you for your whole life. It additionally has living advantages, such as cash value build-up. * American Family Life Insurance coverage Company offers various life insurance policies.

Your representative is a terrific source to answer your inquiries. They may additionally have the ability to assist you discover voids in your life insurance policy coverage or new means to minimize your various other insurance coverage. ***Yes. A life insurance policy recipient can pick to use the fatality advantage for anything - mortgage insurance brokers. It's a terrific means to aid safeguard the economic future of your household if you were to pass away.

Life insurance is one way of helping your family members in paying off a home mortgage if you were to pass away before the mortgage is completely repaid. Life insurance policy proceeds might be utilized to assist pay off a mortgage, yet it is not the exact same as mortgage insurance that you could be required to have as a condition of a funding.

Mortgage Coverage

Life insurance might aid ensure your house remains in your family by giving a fatality advantage that might help pay for a home mortgage or make important acquisitions if you were to die. Contact your American Family members Insurance agent to talk about which life insurance policy plan best fits your needs. This is a quick summary of coverage and is subject to policy and/or cyclist conditions, which may differ by state.

Words life time, long-lasting and permanent go through plan terms and problems. * Any type of car loans taken from your life insurance policy policy will certainly build up interest. bank of ireland mortgage protection insurance. Any type of exceptional finance balance (car loan plus rate of interest) will be subtracted from the survivor benefit at the time of insurance claim or from the cash money worth at the time of abandonment

Discount rates do not apply to the life policy. Policy Forms: ICC18-33 (10 ), ICC18-33 (15 ), ICC18-34 (20 ), ICC18-35 (30 ), L-33 (10 )(ND), L-33 (15 )(ND), L-34 (20 )(ND), L-35 (30 )(ND), L-33 (10 )(SD), L-33 (15 )(SD), L-34 (20 )(SD), L-35 (30 )(SD), ICC18-36 (10 ), ICC18-36 (15 ), ICC18-36 (20 ), ICC18-36 (30 ), L-36 (10 )(ND), L-36 (15 )(ND), L-36 (20 )(ND), L-36 (30 )(ND), L-36 (10 )(SD), L-36 (15 )(SD), L-36 (20 )(SD), L-36 (30 )(SD), ICC17-225 WL, L-225 (ND) WL, L-225 WL, ICC17-227 WL, L-227 (ND) WL, L-227 WL, ICC17-223 WL, L-223 (ND) WL, L-223 WL, ICC17-224 WL, L-224 (ND) WL, L-224 WL, ICC17-228 WL, L-228 (ND) WL, L-228 WL, ICC21, L141, MS 01 22, L141, ND 02 22, L141, SD 02 22.

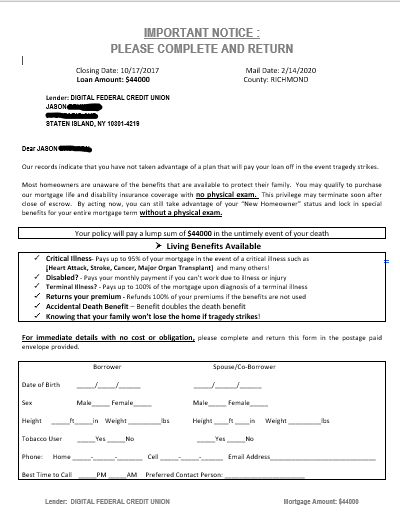

Mortgage defense insurance coverage (MPI) is a different kind of safeguard that can be valuable if you're not able to repay your mortgage. Home loan protection insurance is an insurance plan that pays off the rest of your mortgage if you pass away or if you become impaired and can't work.

Both PMI and MIP are needed insurance coverage coverages. The quantity you'll pay for home loan security insurance depends on a variety of elements, consisting of the insurer and the existing equilibrium of your home mortgage.

Still, there are benefits and drawbacks: Many MPI plans are released on a "assured acceptance" basis. That can be beneficial if you have a health and wellness condition and pay high rates for life insurance coverage or battle to get protection. lenders mortgage insurance policy. An MPI policy can offer you and your household with a complacency

Compare Mortgage Life Insurance

It can likewise be useful for individuals who do not receive or can't pay for a standard life insurance plan. You can pick whether you need home mortgage security insurance policy and for the length of time you require it. The terms typically range from 10 to thirty years. You might want your mortgage protection insurance policy term to be enclose length to for how long you have left to repay your mortgage You can cancel a home mortgage security insurance coverage.

Latest Posts

Funeral Insurance For Over 65

Instant Life Insurance Reviews

Burial Life